Renters Insurance in and around Madison Heights

Your renters insurance search is over, Madison Heights

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

- Madison Heights

- Amherst

- Lynchburg

- Monroe

- Forest

- Lovingtson

- Bedford

- Amherst County

- Nelson County

There’s No Place Like Home

Even when you rent a place to live you still have plenty of responsibility. You want to make sure what you own is protected in the event of some unexpected loss or mishap. And you also need liability protection for friends or visitors who might stumble and fall on your property. State Farm Agent Kim Z Gardner is ready to help you handle the unexpected with reliable coverage for your renters insurance needs. Such personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If if trouble knocks on your door, Kim Z Gardner can help you submit your claim. Keep your home in a rental-sweet-rental state with State Farm!

Your renters insurance search is over, Madison Heights

Coverage for what's yours, in your rented home

There's No Place Like Home

Our daily plans never block time for troubles or disasters. That’s why it makes good sense to plan for the unexpected with a State Farm renters policy. Renters insurance protects your precious belongings with coverage. In the event of abrupt water damage or a tornado, some of your possessions could have damage. If you don't have enough coverage, you may struggle to replace the things you lost. It's scary to think that in one moment, you could lose it all. Despite all that could go wrong, State Farm Agent Kim Z Gardner is ready to help.Kim Z Gardner can help offer options for the level of coverage you have in mind. You can even include protection for valuables when they are outside of your home. For example, if your bicycle is stolen from work, your personal property is damaged by a fire or a pipe suddenly bursts in the unit above you and damages your furniture, Agent Kim Z Gardner can be there to help you submit your claim and help your life go right again.

Renters of Madison Heights, State Farm is here for all your insurance needs. Reach out to agent Kim Z Gardner's office to learn more about choosing the right savings options for your rented townhome.

Have More Questions About Renters Insurance?

Call Kim Z at (434) 528-2845 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

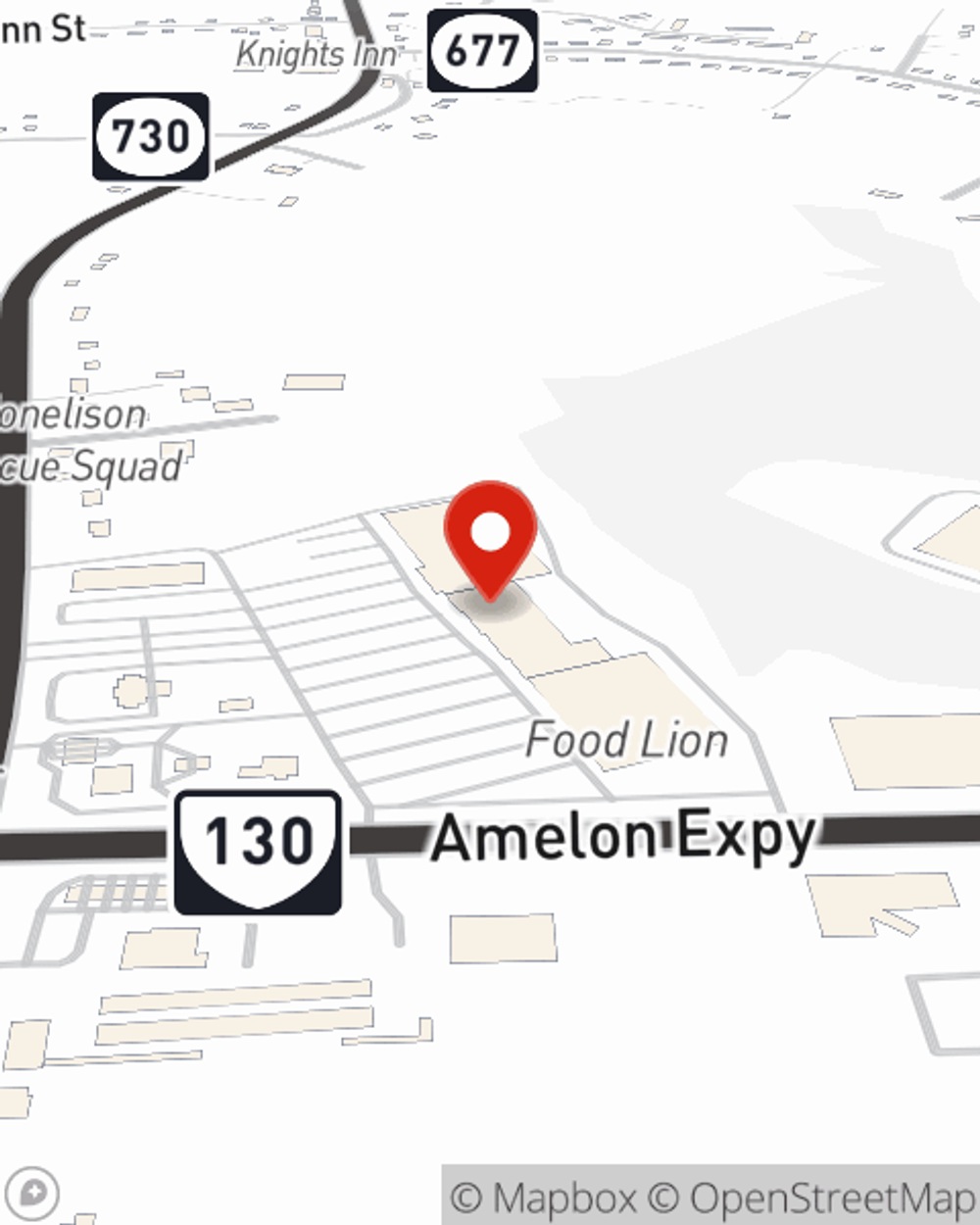

Kim Z Gardner

State Farm® Insurance AgentSimple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.